Disappearing media

This is the 199th edition of SHuSH, the official newsletter of the Sutherland House Inc.

While some famous novels have been written in under a month, major works by major authors are often years in the making. From what I’ve gathered online, the average time it takes to complete a novel is six to eight months of solid work.

I know journalists who’ve completed non-fiction books in as little as three weeks and biographers and historians whose research-heavy projects have required seven or eight years. I would put the average commitment of time for a nonfiction book at about twelve months of solid work.

Few people have six to twelve months just lying around, so something has to give for a book to get done. If you’re fortunate, it’s TV watching or social media, not your day job, your kids, your drinking. On top of making the time, you need to put in the work. For people who take writing seriously, it’s hard work. A lot of intellectual and emotional effort is invested in every sentence on every page.

Not only is writing a book a major undertaking in a person’s life, one of the most challenging and meaningful things you can do, it’s also one of the nobler. Most authors share their art or craft without expectation of a reasonable return for all that’s gone into it. Their primary hope is that you’ll appreciate or benefit from the story they tell. And that’s why I always feel a bit heartbroken when it comes time to sell their books.

We have a sales conference with our US sales agency next week at which we’ll present our Spring 2023 books. Like most independent publishers, our sales are handled by an agency that also handles dozens of other publishers. Only the biggest publishing houses have their own sales forces, and their sales representatives sell the books produced by their dozens (if not hundreds) of imprints. The job of the sales representatives is the same in either case: convince retailers to order from their long slate of offerings as many copies of as many books as possible.

My sales conference will go something like this. I’ll appear by Zoom to a gathering of about thirty sales representatives, all of whom will be in the midst of several days of back-to-back conference calls. Some of these reps will sell to Barnes & Noble, some to independent bookstores in one geographical region or another, some to the library market, etc. I expect I’ll be the seventh or eighth of a dozen or more publishers the reps will meet on the day. I’ll give them a five-minute pitch on each book (a lead title might get ten minutes). That’s enough time to cover the same amount of information you’d read in a brief description of a book on Amazon.

The reps will hardly look at me as I speak. They’ll be staring at their screens on to which they’ll have uploaded from an electronic catalogue all the basic information about our books along with the cover and a few words about the author. They’ll take notes as I speak or maybe just check off each book as it’s presented. They are mostly listening for a line or two that they can turn around and use on the nonfiction buyer at B&N or some independent in Chattanooga: this subject is going to be in the news; first-time author with a huge following on Instagram; the definitive biography of the only person to…

You can sometimes reach the end of the conference (ours are about forty-five minutes) having heard only your own voice. Not a peep from the reps. If you get a good group, which more experienced publishers tell me is most likely early in the day and early in the week, you’ll get questions or comments. These are almost always about the presentation of the book. Love that cover. Is that image a bit too dark for the subject matter? Your title doesn’t seem to match your description of the book.

That beautiful paragraph at the end of chapter seven that took the author weeks to write? No one cares. Not in this process. The reps won’t have read the books; they probably never will. It’s not that they don’t like to read; there are simply too many books.

By the end of the week-long sales conference, the reps will have been bombarded by 500 or more titles. They are unlikely to remember a great deal about any individual book. They’ll have formally or informally ranked the lot, from those they’re sure they can sell to those that aren’t worth the effort. In preparation for meetings with buyers, they’ll condense all they’ve learned from the publisher presentations into their own much shorter presentations.

Book buyers at retail outlets will have a certain amount of shelf space available for particular genres of books each season. The rep’s objective is to occupy as much of that space as possible on behalf of his or her publishers, understanding that a lot of other sales agents will be trying to get their books into the same space—the number of books published every year is orders of magnitudes above what even the biggest bookstores can stock. Needless to say, the reps lead with their best stuff. There isn’t time to make even a short pitch for every book they’re charged with selling. They do their best under the circumstances.

It’s important to remember that the individuals involved in these processes are all well-intentioned, book-loving people—they certainly aren’t in it for the money. Some reps and buyers read or skim a surprising number of books each season. They look hard at how a book is presented to them and often have good ideas for improving its chances of success. If Sutherland House has competing ideas for a particular book cover, we often seek input from our sales agents. We’ve also had buyers from chains give us useful feedback prior to a book’s publication. These conversations are entirely focused on what might be considered the marketing elements of the book—titles, subtitles, covers, descriptions, formats—rather than content, but these elements heavily influence buying decisions.

If it can be said that there are advantages to participating in the massive, impersonal machinery of contemporary bookselling, one is that reps and buyers see many thousands of books go to market each season and develop a good eye for what will or won’t work with the buying public. They are generous with their insights, which can be invaluable to publishers.

I should also add that the merits of the contents of a book aren’t entirely irrelevant to the sales process. It’s up to a book’s description to communicate that this history is wildly entertaining, this novel turns convention on its head, or this author has outdone herself. Content matters, in a brutally reductive way.

Appalling as it might be for an author who has devoted a year of his life to a manuscript to learn that the lovingly finished project will be marketed on the basis of short and superficial conversations among people who’ve never read it, he should count himself lucky when it happens. Again, only a small minority of books published each year make it onto the shelves of Barnes & Noble and independent bookstores. Most books are sold programmatically, without human interface.

No one can sell a book to Amazon. Its algorithms decide what it will buy and in what volume. It absorbs a book’s metadata: title, subtitle, author name, ISBN number, book description, price, publication date, keywords, comparable titles, and BISAC subject codes, all of which the publisher has entered into a database. (BISAC codes are standardized categories into which books get slotted for the convenience of libraries and booksellers. A typical book may get coded like this: “FIC022020 FICTION / Mystery & Detective / Police Procedural.”) Amazon weighs this information along with other factors—it is highly sensitive to reviews—and dumps the book into one of its own weird categories, which is how it shows up on the site as “#125 in Witch & Wizard Thrillers” or “#72 in History & Criticism of German Literature.” The infamous Amazon algorithm then decides when and how to present the book in response to a customer’s search query on the platform.

It is probably the most trivializing and dehumanizing thing that can be done to a work of literature, reducing it to a crude string of data, but that’s the fate of every book sold on Amazon, the websites of Walmart and retail bookselling chains, as well as some independents. Aggravating as it is for a publisher to have to summarize something as big and complicated and meaningful as a book in a five-minute Zoom spiel, it’s far preferable to programmatic sales.

As a publisher, I’ve learned to accept and acclimate to how we sell books today. One masters the processes as best one can.

As an author, I try not to think about this part of the business. It hurts the heart.

This is the 199th edition of SHuSH, the official newsletter of the Sutherland House Inc.

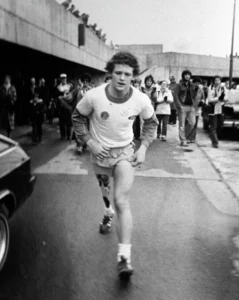

There was an interesting piece in the New York Times a week or so ago about James Daunt (above), the incoming chief executive of Barnes & Noble, the most important bookstore chain in the English-speaking world. It didn’t quite get to the nub of the matter. Barnes & Noble has

The world of non-fiction from Sutherland House ( and Beyond )